UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| Preliminary Proxy Statement | |||||

| ☐ | |||||

| the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

| ☒ | |||||

| Definitive Proxy Statement | |||||

| ☐ | Definitive Additional Materials | ||||

| Soliciting Material under Rule 14a-12 | |||||

| CROWN HOLDINGS, INC. | |||||

| (Name of registrant as specified in its charter) | |||||

| (Name of person(s) filing proxy statement, if other than the registrant) | |||||

| Payment of Filing Fee (Check the appropriate box): | |||||

| ☒ | No fee required. | ||||

| ☐ | |||||

| 0-11. | |||||

| (1) | Title of each class of securities to which transaction applies: | ||||

| (2) | Aggregate number of securities to which transaction applies: | ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

| (4) | Proposed maximum aggregate value of transaction: | ||||

| (5) | Total fee paid: | ||||

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount Previously Paid: | ||||

| (2) | Form, Schedule or Registration Statement No.: | ||||

| (3) | Filing Party: | ||||

| (4) | Date Filed: | ||||

Crown Holdings, Inc.

770 Township Line Road

Yardley, Pennsylvania 19067

________________________

iNOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

________________________

| Date: | April 22,2021 | |

| Time: | Online check-in begins: | 9:15 a.m. Eastern Time |

| Online Meeting begins: | 9:30 a.m. Eastern Time | |

| Place: | Meeting via the Internet – please visit: www.virtualshareholdermeeting.com/CCK2021 | |

| Purposes: | · | Elect Directors |

| · | Ratify the appointment of independent auditors for the fiscal year ending December 31, 2021 | |

| · | Vote on an advisory resolution to approve executive compensation for the Named Executive Officers as disclosed in this Proxy Statement | |

| · | Conduct such other business as may properly come before the Annual Meeting | |

All Shareholders are cordially invited to attend our virtual Annual Meeting of Shareholders, conducted via the Internet. Due to the ongoing public health impact of the COVID-19 pandemic and the travel and public gathering restrictions that have been imposed throughout Pennsylvania as a result thereof, the Annual Meeting will be held in a virtual meeting format to support the health and well-being of the Company’s Shareholders, employees and their families. Shareholders will not be able to attend the Annual Meeting in person this year.

Only Shareholders as of the close of business on March 2, 2021, the record date for the Annual Meeting, may participate and vote at the meeting. During the virtual Meeting, you may submit questions and will be able to vote your shares electronically. To participate, you will need the 16-digit control number included on your proxy card or voting instruction form. We encourage you to allow ample time for online check-in, which will begin at 9:15 a.m. Eastern Time on April 22, 2021.

This Proxy Statement, the Proxy Card relating to the Annual Meeting of Shareholders and the Annual Report to Shareholders are available electronically at: www.crowncork.com/investors/proxy-online.

| By Order of the Board of Directors | ||||||

| | ||||||

| ADAM J. DICKSTEIN | ||||||

| Corporate Secretary | ||||||

| Yardley, Pennsylvania | ||||||

| March 15, 2021 | ||||||

ADDITIONAL INFORMATION ABOUT THE 2021 VIRTUAL ANNUAL MEETING

Attendance and Participation

Only Shareholders as of the close of business on March 2, 2021, which is the record date for the Annual Meeting, will be entitled to participate online, vote their shares electronically and submit questions during the Annual Meeting. You will be able to access the meeting at www.virtualshareholdermeeting.com/CCK2021 using your 16-digit control number.

We encourage you to access the virtual Annual Meeting before the start time of 9:30 a.m., Eastern Time, on April 22, 2021. Please allow ample time for online check-in, which will begin at 9:15 a.m., Eastern Time, on April 22, 2021. The decision to have a virtual Annual Meeting again this year due to the ongoing public health impact of the COVID-19 pandemic does not represent a change in our Shareholder engagement philosophy. The Company expects to return to an in person meeting next year.

The virtual Annual Meeting platform is fully supported across browsers (Internet Explorer, Microsoft Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection wherever they intend to participate in the Annual Meeting. Participants should also allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

Shareholder Lists

A list of the Shareholders entitled to vote at the meeting will be open to examination by any Shareholder during the meeting.

Questions

Shareholders may submit questions during the Annual Meeting. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/CCK2021, typing your question into the “Ask a Question” field, and clicking “Submit.” Questions pertinent to the Annual Meeting will be answered during the Annual Meeting, subject to time constraints.

Technical Support

If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call 844-986-0822 (Toll Free) or 303-562-9302 for assistance. Technical support will be available beginning at 9:15 a.m. Eastern Time on April 22, 2021 through the conclusion of the Annual Meeting.

TABLE OF CONTENTS

| 2021 Proxy Statement Summary | 1 | |

| Questions & Answers about the 2020 Annual Meeting | 11 | |

| Proposal 1: Election of Directors | 17 | |

| Director Compensation | 21 | |

| Common Stock Ownership of Certain Beneficial Owners, Directors and Executive Officers | 23 | |

| Corporate Governance | 25 | |

| Compensation Discussion and Analysis | 31 | |

| 2020 Say-On-Pay Vote Results | 31 | |

| At-Risk Compensation | 32 | |

| Pay-for-Performance Alignment - Performance-Based Shares | 33 | |

| Role of the Compensation Committee | 33 | |

| Compensation Philosophy and Objectives | 33 | |

| Committee Process | 34 | |

| Role of Executive Officers in Compensation Decisions | 35 | |

| Executive Compensation Consultant | 35 | |

| Use of Benchmarking | 35 | |

| Peer Group Composition | 35 | |

| Compensation Strategy for CEO | 36 | |

| Compensation Strategy for NEOs other than the CEO | 37 | |

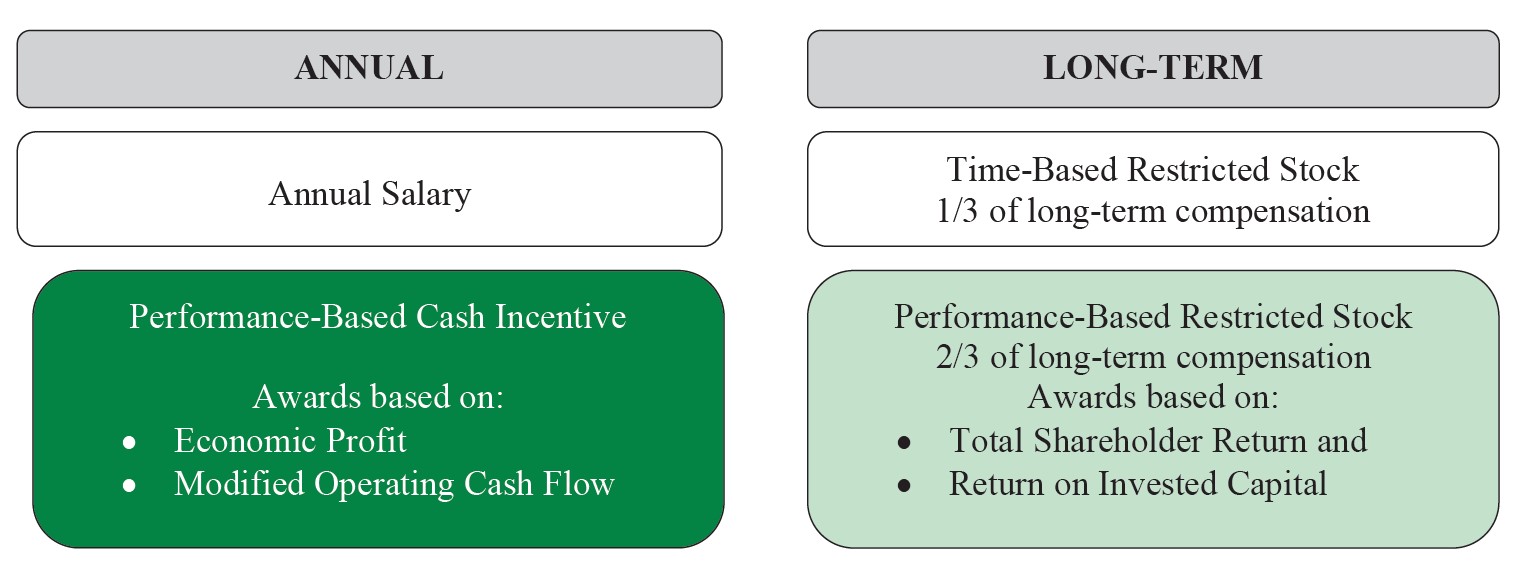

| Components of Compensation | 37 | |

| Base Salary | 37 | |

| Annual Incentive Bonus | 38 | |

| Long-Term Equity Incentives | 41 | |

| Retirement Benefits | 45 | |

| Perquisites | 46 | |

| Severance | 46 | |

| Tax Deductibility of Executive Compensation | 46 | |

| Compensation Committee Report | 47 | |

| Executive Compensation | 49 | |

| Summary Compensation Table | 49 | |

| Grants of Plan-Based Awards | 51 | |

| Outstanding Equity Awards at Fiscal | ||

| Year-End | 53 | |

| Option Exercises and Stock Vested | 55 | |

| Pension Benefits | 56 | |

| Employment Agreements and Potential | ||

| Payments upon Termination | 57 | |

| Pay Ratio Disclosure | 60 | |

| Principal Accountant Fees and Services | 61 | |

| Audit Committee Report | 62 | |

| Proposal 2: Ratification of Appointment of Independent Auditors | 63 | |

| Proposal 3: Advisory Vote to Approve Executive Compensation | 64 | |

| Other Matters | 65 |

| i |

2021 PROXY STATEMENT SUMMARY

This is a summary only and does not contain all of the information that you should consider. We urge you to carefully read the entire Proxy Statement before voting.

Crown Holdings, Inc. - 20192021 Virtual Annual Meeting

Time and Date: | 9:30 a.m. |

Place: | |

Record | March |

2021 Annual Meeting Proposals

| Agenda Item | Board Recommendation | Page |

| 1. Election of Directors | FOR EACH DIRECTOR NOMINEE | |

| 2. Ratification of appointment of Independent Auditors | FOR | |

| 3. Advisory vote to approve executive compensation | FOR | |

How to Cast Your Vote

You can vote by any of the following methods:

| Internet | Phone | |||||

|  |   |  |   | ||

www.proxyvote.com Deadline for voting online is 11:59 p.m. | 1-800-690-6903 Deadline for voting by phone is 11:59 p.m. | 21, 2021. | Mark, sign and date your proxy card and return it in the postage-paid envelope provided. Your proxy card must be received before the Annual Meeting. | You may vote online during the Annual Meeting at meeting.com/CCK2021 | ||

| 1 |

1

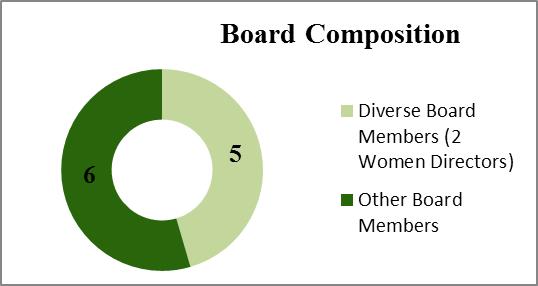

There are eleventhirteen nominees for election to the Board of Directors. AdditionalThis year’s Board nominees include one new Director – Dwayne Wilson. Six of the Company’s independent Directors have joined the Board in the last five years as a result of a Board refreshment process where Director candidates were identified through Board, Shareholder and third-party search firm input. Our Board refreshment strategy has further strengthened and diversified the skills and experiences of the Board. Each Director nominee is listed below, and you can find additional information onabout each nominee may be found under Proposal 1: Election of Directors, beginning on

| Director | Committee Memberships | |||||||||||||

| Name and Primary Occupation | Age | Since | Independent | A | C | NCG | E | |||||||

John W. Conway Chairman of the Board of the Company | 75 | 1997 | Yes | Chair | ||||||||||

Timothy J. Donahue President and Chief Executive Officer of the Company | 58 | 2015 | No | ✓ | ||||||||||

Richard H. Fearon Vice Chairman and Chief Financial and Planning Officer of Eaton Corporation[1] | 64 | 2019 | Yes | |||||||||||

Andrea J. Funk VP Finance, Americas of EnerSys | 51 | 2017 | Yes | ✓ | ✓ | |||||||||

Stephen J. Hagge Former President and Chief Executive Officer of AptarGroup | 69 | 2019 | Yes | ✓ | ||||||||||

Rose Lee President of DuPont Water & Protection | 55 | 2016 | Yes | ✓ | ||||||||||

James H. Miller Former Chairman and Chief Executive Officer of PPL Corporation | 72 | 2010 | Yes | ✓ | Chair | ✓ | ||||||||

Josef M. Müller Former Chairman and Chief Executive Officer of Nestlé in the Greater China Region | 73 | 2011 | Yes | ✓ | ✓ | |||||||||

B. Craig Owens Former Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company | 66 | 2019 | Yes | ✓ | ||||||||||

Caesar F. Sweitzer Former Senior Advisor and Managing Director of Citigroup Global Markets | 70 | 2014 | Yes | Chair | ✓ | ✓ | ||||||||

Jim L. Turner Chief Executive Officer of JLT Beverages; former Chairman, President and Chief Executive Officer of Dr Pepper/Seven Up Bottling Group | 75 | 2005 | Yes | Chair | ✓ | ✓ | ||||||||

William S. Urkiel Former Senior Vice President and Chief Financial Officer of IKON Office Solutions | 75 | 2004 | Yes | ✓ | ✓ | |||||||||

Dwayne A. Wilson Former Senior Vice President of Fluor Corporation | 62 | 2020 | Yes | ✓ |

.

| Committee Memberships | ||||||||||||||||||||

Name and Primary Occupation | Age | Director Since | Independent | A | C | NCG | E | |||||||||||||

John W. Conway Chairman of the Board of the Company | 73 | 1997 | Yes | Chair | ||||||||||||||||

Timothy J. Donahue President and Chief Executive Officer of the Company | 56 | 2015 | No | ✓ | ||||||||||||||||

Andrea J. Funk VP Finance, Americas of EnerSys | 49 | 2017 | Yes | ✓ | ✓ | |||||||||||||||

Rose Lee President of DuPont Safety & Construction | 53 | 2016 | Yes | ✓ | ✓ | |||||||||||||||

William G. Little Former Chairman and Chief Executive Officer of West Pharmaceutical Services | 76 | 2003 | Yes | Chair | ✓ | |||||||||||||||

Hans J. Löliger Vice Chairman of GTF Holding | 76 | 2001 | Yes | Chair | ✓ | |||||||||||||||

James H. Miller Former Chairman and Chief Executive Officer of PPL Corporation | 70 | 2010 | Yes | ✓ | ✓ | |||||||||||||||

Josef M. Müller Former President of Swiss Association of Branded Consumer Goods “PROMARCA” | 71 | 2011 | Yes | ✓ | ✓ | |||||||||||||||

Caesar F. Sweitzer Former Senior Advisor and Managing Director of Citigroup Global Markets | 68 | 2014 | Yes | Chair | ✓ | |||||||||||||||

Jim L. Turner Principal of JLT Beverages; Chairman of Dean Foods | 73 | 2005 | Yes | ✓ | ✓ | |||||||||||||||

William S. Urkiel Former Senior Vice President and Chief Financial Officer of IKON Office Solutions | 73 | 2004 | Yes | ✓ | ✓ | |||||||||||||||

1Mr. Fearon will retire as an officer of Eaton Corporation on March 21, 2021.

| 2 |

| Less than 6 years | 6 – 10 years | More than 10 years | ||

|    |     | ||

Ongoing Board Refreshment – six new directors in five years | ||||

| Board Independence and Diversity | |

| Board Composition · Two female directors · One African American director · One Asian American director · One non-U.S. citizen director |

The eleventhirteen Director nominees standing for reelection to the Board have diverse backgrounds, skills and experiences. We believe their varied backgrounds contribute to an effective and well-balanced Board that is able to provide valuable insight to, and effective oversight of, our senior executive team.

| 3 |

|

3

The Board of Directors is committed to implementing and maintaining strong corporate governance.governance practices. The Board continually monitorsadopts emerging best practices in governance to bestthat enhance the effectiveness of the Board and our management and that serve the best interests of the Company’s Shareholders. The Corporate Governance section beginning on page 2625 describes our governance framework. We call your attention to the following best practices.

| Annual election of all Directors |

| Resignation policy applicable to Directors who do not receive a majority of votes cast in uncontested elections |

| Mandatory retirement policy for Directors |

| ü | Proxy access |

| Overboarding limits |

| Independent |

| Executive sessions of |

| Annual review of Committee charters and Corporate Governance Guidelines |

| ü | Robust stock ownership guidelines for Directors and Named Executive Officers |

| Prohibition on all pledging and hedging of the Company’s stock by Directors, Officers and other insiders |

| Annual advisory vote on executive compensation |

| ü | Code of Business Conduct and Ethics that applies to Directors and employees |

| No supermajority voting requirement to amend By-Laws |

| No poison pill |

| Oversight of sustainability/ |

| ü | Integration of Diversity and Inclusion in the Company’s Sustainability program, overseen by the Nominating and Corporate Governance Committee |

| ü | Board oversight of cybersecurity |

Shareholder Engagement

The Company has developed a multi-platform Shareholder engagement program that results in active dialogue with both current and prospective global Shareholders.Shareholders all over the world. Major elements of the program include individual or group investor meetings, scheduled teleconferences, participation in sponsored institutional investor conferences and investor visits to Company manufacturing or administrative facilities. In December 2018, the Company also hosted current and prospective investors at a special conference at one of the facilities of the Company’s new Transit Packaging Division. Participants also joined the conference via webcast. Subjects of discussion at these events include long-term strategy, historical and pro forma financial information, recent and pending acquisitions and divestitures, major trends and issues affecting the Company’s businesses, industry dynamics, executive compensation, sustainability and corporate governance, among other matters. In addition, since the November 2019 announcement of our ongoing Board-led review of our portfolio and capital allocation/return and our continuing Board refreshment process, our Shareholder engagement has included the receipt of Shareholder perspectives on our businesses and capital allocation as well as our Board composition. During last year’s engagement cycle we estimate that we had personal contact with investors owning well over 50% of the Company’s outstanding shares.

| 4 |

4

Sustainability

The Company issued its most recent biennial Sustainability Report in 2017.February 2020. The report uses the Global Reporting Initiative’s G4 guidelines and is available in full at sustainability.crowncork.com. The Company’s next Sustainability Report will be a supplement report published in the Spring of 2021 to close out our 2020 goals and transition to our Twentyby30 program.

https://sustainability.crowncork.com.

| · | We participate in |

| · | For 2020 Crown achieved a top score for CDP Supplier Engagement, scoring in the top 7% of all 8,033 companies reporting to CDP. The supplier engagement score provides a rating for how effectively companies engage their suppliers on climate change. |

| · | The Company expects to report under the SASB methodology in its next Sustainability Report, which will be published in the Spring of 2021. |

| · | We established a goal to reduce energy consumption by 5% per billion standard units of production (our unit of measure for metal packaging defined in the report) from 2015 levels by the end of 2020. As of December 31, |

1We arecontinue actively working to integrate our new Transit Packaging Division, which has a much more diverse set of product offerings and manufacturing formats than our metal packaging business, into our sustainability measurement methodology. The data above do not include Transit Packaging. Nevertheless, we note that a large percentage of the products sold fromby the Transit Packaging Division are themselves made from recycled materials and that the Transit Packaging Division itself recycles millions of pounds of material to manufacture its products. We expect that our Transit Packaging Division will be integrated into all future Sustainability Reports.

| 5 |

| · | We established a goal to reduce Scope 1 and Scope 2 greenhouse gas emissions by 10% per billion standard units of production from 2015 levels by the end of 2020. As of December 31, 2019, we exceeded this goal, with greenhouse gas emissions reduced by 10.8% per billion standard units. Absolute emissions have decreased by 1.1% even as production has increased by 13.9%. | |

| · | During the reporting period, the Company won numerous awards in multiple U.S. states and in all three of our global geographic divisions in areas such as safety, recycling, pollution prevention and green manufacturing. |

The Company has taken many additional steps in our sustainability efforts, including the following:

| · | We signed one of the largest non-investment grade “sustainability-linked loans” in history. The interest rate on the Company’s revolving credit facility will increase or decrease, in part, based on the annual environmental, social and governance scores received by the Company from one of the major third-party sustainability ratings agencies. |

| · | We announced plans to reduce water usage in our global operations by 20% from 2019 levels by the end of 2025. These efforts will decrease the Company’s water usage by over 500 million gallons annually. |

| · | We joined RE100, pledging a total transition to 100% renewable electricity by 2050, with interim targets of 60% by 2030, and 90% by 2040. |

| · | We committed to the Science-Based Targets initiative (“SBTi”), which requires the Company to set specific goals for reducing GHG emissions. These targets, which have been accepted by the SBTi, align with global temperature increase limits of 1.5° C set by the Paris Agreement of 2015. The Company established a Scope 1 and 2 emissions reduction goal of 50% by 2030. Additionally, the Company established a Scope 3 goal of 16% emissions reduction by 2030. |

| · | In July 2020, the Company introduced its next phase of Sustainability with the launch of its Twentyby30 program. This ambitious and aggressive program commits to twenty measurable goals to be achieved by 2030 or sooner and is available at www.crowncork.com/sustainability/twentyby30-overview. |

| · | We launched our new Supplier Code of Conduct, available at www.crowncork.com/investors/corporate-governance/supplier-code-conduct, to align supplier conduct with the Company’s core values. |

| · | In the past year, we have issued public policy statements on Environmental Sustainability, Human Rights, Responsible and Ethical Sourcing, Tax Strategy and Conflict Minerals, all of which are available at www.crowncork.com. |

| 6 |

5

As a matter of good corporate governance, we are asking you to ratify the selection by the Audit Committee of PricewaterhouseCoopers LLP (“PwC”) as our independent auditors for 2019.2021. The following table summarizes the fees PwC billed to the Company for 2018.

Audit Fees | Audit-Related Fees | Tax Compliance Fees | Tax Advisory Services Fees | All Other Fees |

| $10,065,000 | $711,000 | $426,000 | $1,757,000 | $71,000 |

| Audit Fees | Audit-Related Fees | Tax Compliance Fees | Tax Advisory Services Fees | All Other Fees |

| $9,408,000 | $6,315,000 | $320,000 | $1,148,000 | $21,000 |

Additional information in the section titled “Principal Accountant Fees and Services” and the Audit Committee Report may be found on

pages.

At the 20182020 Annual Meeting, the say-on-pay resolution with respect to 2018 Named Executive Officer (“NEO”) compensation received a favorable vote of over 95%96%. Accordingly, the general approach to the compensation of theour NEOs, including the Chief Executive Officer (“CEO”), remained largely unchanged. See Compensation and Discussion Analysis (“CD&A”) that begins on page 30.31. Below is a summary of the CEO’s compensation for 2016, 20172018, 2019 and 2018.2020. Compensation of Mr. Donahue and the other NEOs is more fully described in the Summary Compensation Table on page 46.

| Name and Position | Year | Salary | Grant Date Projected Value of Unvested Restricted Stock Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value | All Other Compensation | Total Compensation | Total Compensation Net of Certain Retirement-Related Benefits |

Timothy Donahue President and Chief Executive Officer | 2020 | $1,200,000 | $6,239,951 | $2,880,000 | $5,714,297 | $1,486,791 | $17,521,039 | $10,324,226 |

| 2019 | 1,155,000 | 6,005,970 | 1,711,710 | 4,056,957 | 1,081,053 | 14,010,690 | 8,876,880 | |

| 2018 | 1,100,000 | 5,720,055 | 1,735,800 | 1,183,618 | 77,268 | 9,816,741 | 8,566,727 |

The last column above shows Total Compensation net of certain retirement-related benefits (i.e., the Change in Pension Value column and certain retirement-related elements of All Other Compensation). The lump-sum present value calculations required to be included for all of our NEOs in this Proxy Statement for certain components of Total Compensation continue to be inflated by historically-low interest rates. Not all of the pension benefits payable to our NEOs will be paid in a lump sum. Future increases in interest rates could cause a significant reduction in the lump-sum value of such benefits. See page 56, footnote 4, for more information about interest rate sensitivity.

| Name and Position | Year | Salary | Grant Date Projected Value of Unvested Restricted Stock Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value | All Other Compensation | Total Realizable Compensation(1) | Total Actual Realized Compensation(2) |

Timothy Donahue President and Chief Executive Officer | 2018 | $1,100,000 | $5,720,055 | $1,735,800 | $1,183,618 | $ 77,268 | $ 9,816,741 | $5,498,602 |

| 2017 | 1,000,000 | 5,200,004 | 2,295,600 | 2,810,148 | 634,208 | 11,939,960 | 8,500,616 | |

| 2016 | 915,000 | 5,051,113 | 2,594,849 | 1,994,476 | 419,188 | 10,974,626 | 6,974,883 |

| 7 |

6

The Company has developed an executive compensation program that is ownership-oriented and that rewards the attainment of specific annual and long-term goals that will result in improvement in Shareholder value. Two-thirds of our NEOs’ share awards are performance-based, andperformance-based. Beginning with 2017 grants, which vested in early 2020, vesting has beenis based on two performance metrics: the Company’s relative total shareholder return (“TSR”) against a peer group (and beginning with 2017 grants, also on(the Dow Jones U.S. Containers & Packaging Index) and the Company’s return on invested capital as a second metric)(“ROIC”).

Based on the Company’s TSR under-performance versus its peer groupperformance for the measurement periodsperiod related to the vesting of performance-based shares in 2018 and 2019,2020, the Company’s NEOs, including the CEO, received awards that were 21.3% above the target grants established in 2017. However, due to the Company’s under-performance for the measurement periods related to the performance-based shares vesting in 2018 and 2019, the NEOs forfeited 100% of the performance-based shares awarded to them.granted in 2015 and 2016. Such additional awards and forfeitures display a clear and direct correlation between pay-for-performance and our executives’ compensation. This performance-based vesting history illustrates a strong pay-for-performance alignment.

| 8 |

7

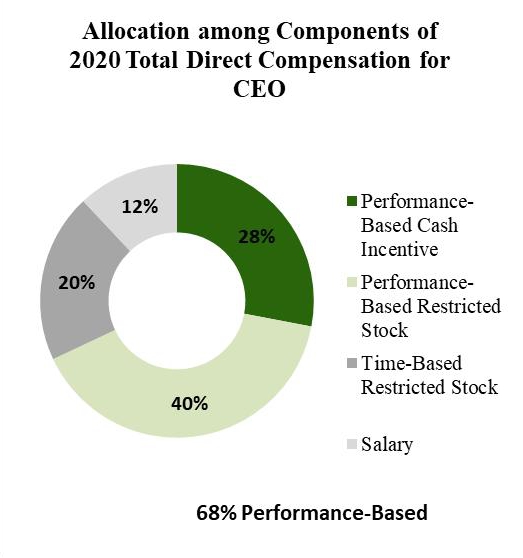

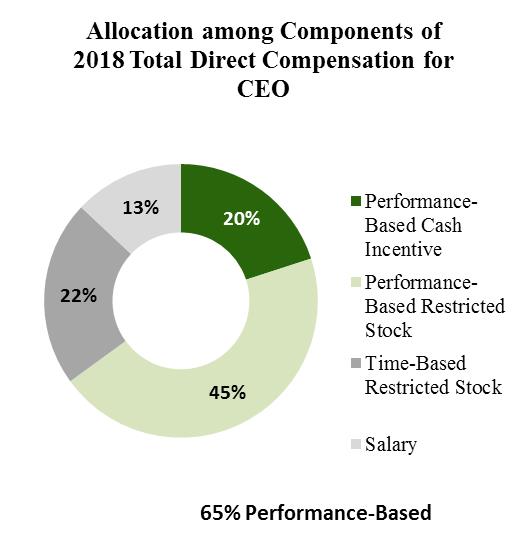

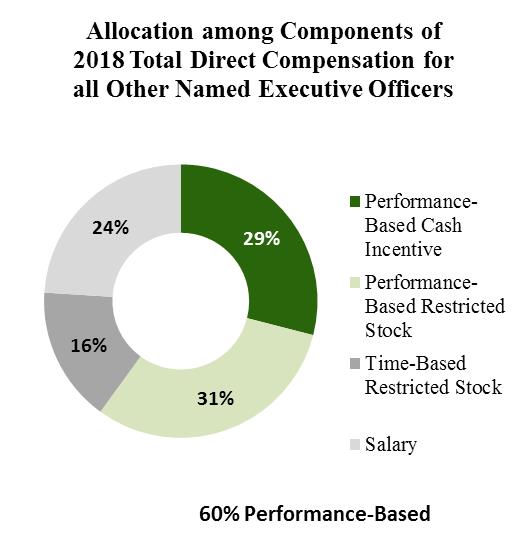

The allocation of 20182020 total direct compensation for our CEO and for our other NEOs among the various components of compensation is set forth in the following charts that highlight the Company’s emphasis on “at risk” and equity-based compensation.

|

|

| 9 |

|  |

8

WHAT WE DO

Benchmark our NEOs’ total direct compensation at the 50th percentile of our peer group |

| Review pay and performance alignment annually |

| ü | Provide a majority of the direct compensation paid to our NEOs in performance-based compensation |

| Allocate two-thirds of compensation under the Company’s long-term incentive plan to performance-based share awards and one-third to time-based share awards |

| Vest performance-based shares on the basis of two metrics (total shareholder return and return on invested capital) |

| Base payouts under the Company’s Annual Incentive Bonus Plan on the achievement of specified levels of economic profit and modified operating cash flow |

| “Clawback” non-equity incentive bonus payments |

| Engage an independent compensation consultant for our Compensation Committee |

| Annually review the independence of the compensation consultant retained by the Compensation Committee |

| ü | Utilize tally sheets to review total compensation, compensation mix, internal pay equity, payouts under certain potential termination scenarios and the aggregate value of retirement benefits and interest rate sensitivity on retirement benefits |

| Hold annual |

WHAT WE DON’T DO

| Allow carry-forward or banking of economic profit or modified operating cash flow achievement in |

| Use subjective individual qualitative factors in determining executives’ annual bonuses |

| Include tax gross-up provisions in any new or revised executive employment agreements |

| Provide excessive perquisites |

| Permit any form of hedging or pledging of Company stock |

Please read the CD&A, beginning on page 30,31, for a more detailed description of the Company’s executive compensation program.

| 10 |

QUESTIONS & ANSWERS ABOUT THE 20192021 ANNUAL MEETING

Why am I receiving these materials?

The Company is providing you this Proxy Statement, the accompanying Proxy Card and a copy of our Annual Report for the year ended December 31, 2018,2020, containing audited financial statements, in connection with our Annual Meeting of Shareholders or any adjournments or postponements of the Annual Meeting. The Meeting will be heldconducted via the Internet on April 25, 201922, 2021 at 9:30 a.m. local time at the Company’s Corporate Headquarters located at 770 Township Line Road, Yardley, Pennsylvania. As a ShareholderEastern Time. All Shareholders of the Company you are cordially invited to attend theour virtual Annual Meeting and are entitled and requested to vote on the matters described in this Proxy Statement. The accompanying Proxy is solicited on behalf of the Board of Directors of the Company. We are mailing this Proxy Statement and the accompanying Proxy Card and Annual Report to our Shareholders on or about March 18, 2019.

What is a Proxy?

A Proxy is your legal designation of another person to vote the shares that you own in accordance with your instructions. The person you appoint to vote your shares is also called a Proxy.Proxy Holder. On the Proxy Card you will find the names of the persons designated by the Company to act as ProxiesProxy Holders to vote your shares at the Annual Meeting. The Board is asking you to allow any of the persons named as ProxiesProxy Holders on the Proxy Card (all of whom are Officers of the Company) to vote your shares at the Annual Meeting. The ProxiesProxy Holders must vote your shares in the manner you instruct.

Who is entitled to vote?

Only Shareholders as of the close of business on March 5, 20192, 2021 (“Record Date”) are entitled to receive notice of, to attend and to vote at the Annual

Meeting or any adjournment or postponement of the Annual Meeting. Each Shareholder has one vote per share on all matters to be voted on. As of the Record Date, there were 135,328,379134,912,097 shares of Common Stock outstanding.

What is the difference between a “record owner” and a “beneficial owner”?

Record Owners: If your shares are registered directly in your name with EQ Shareowner Services, the Company’s stock transfer agent, you are considered the “Shareholder of record” or “record owner” with respect to those shares. You vote your shares directly and may vote in-person atonline directly during the Annual Meeting with no prior authorizations required.

Beneficial Owners: If your shares are held in an account at a brokerage firm, bank or trust as custodian on your behalf, you are considered the “beneficial owner” of those shares. Your shares are registered on the Company’s books in the name of the brokerage firm, bank or trust, or its nominee. Shares held in this manner are commonly referred to as being held in “street name.” As the beneficial owner of the shares, you have the right to direct your broker, bank or trustee how to vote your shares by using the votevoting instruction cardform sent to you along with this Proxy Statement. You also are invited to attend the virtual Annual Meeting. However, because a beneficial owner is not the Shareholder of record,Meeting and you may not vote these shares in person atonline during the Annual Meeting or participate inby following the Annual Meeting, unless you obtain a legal proxy from theinstructions provided by your broker, bank or trust who is the Shareholder of record, or holds a legal proxy from the Shareholder of record, giving you the right to vote the shares at the Annual Meeting.with your voting instruction form.

| 11 |

12

Shareholders will vote on fourthree proposals at the Annual Meeting:

| · | the election of Directors |

| · | the ratification of the appointment of the Company’s independent auditors for the fiscal year ending December 31, |

| · | an advisory resolution to approve the compensation of the Named Executive Officers as disclosed in this Proxy Statement (the “Say-on-Pay” vote) |

The Company also will consider any other business that properly comes before the Annual Meeting in accordance with Pennsylvania law and the Company’s By-Laws.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote your shares:

· | “FOR”each of the nominees for election to the Board |

· | “FOR”the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for |

· | “FOR”the advisory resolution to approve the compensation of the Named Executive Officers as disclosed in this Proxy Statement |

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a Proxy to the personsProxy Holders named on the Proxy Card, they will have the discretion to vote your

shares in their best judgment with respect to any additional matters properly brought before the Annual Meeting in accordance with Pennsylvania law and the Company’s By-Laws. Also, if for any reason any of our nominees are not available as candidates for Director, the persons named as ProxiesProxy Holders will vote the Proxies for any other candidate or candidates who may be nominated by the Board.

How do I vote my shares?

You may vote your shares by Proxy or in person.during the virtual meeting. You may vote by Proxy by:

· | by the Internet, at the web address provided on page 1 of this Proxy Statement or on your Proxy Card or voting instruction form; or |

| · | by telephone, using the toll-free number listed on page 1 of this Proxy Statement or on your Proxy Card or |

by mail, by marking, signing, dating and mailing your Proxy Card or |

| · | during the Meeting, by using the unique 16-digit control number which appears on the proxy card, if you are a record owner; if you are a beneficial owner, your 16-digit control number will be contained on the voting instruction form provided by your bank or broker. |

The deadline for voting by telephone or electronically through the Internet is 11:59 p.m. CentralEastern Time, April 24, 2019.21, 2021.

| 12 |

Will my shares be voted if I do not provide my Proxy?

It depends on whether you are a record owner or beneficial owner. If you are a record owner, your shares will NOT be voted unless you provide a Proxy or attend and vote in persononline at the Annual Meeting. For beneficial owners who hold shares in street name through brokerage firms, those firms generally have the authority to vote their clients’ unvoted shares in their discretion on certain routine matters. For example, if you are a beneficial owner and you do not provide voting instructions, your brokerage firm may vote your shares with respect to the ratification of the appointment of independent auditors (Proposal 2), as this matter is considered routine under the applicable New York Stock Exchange (“NYSE”) rules. All other matters to be voted on at this year’s Annual Meeting are not considered routine, and your broker voting on a routine matter cannot vote your shares on those non-routine matters without your instruction (“broker non-votes”).

Beneficial Owners: The Company urges you to instruct your broker, bank or trust on how to vote your shares.

What constitutes a quorum?

The presence, in personby attendance at the virtual Annual Meeting or by Proxy, of Shareholders entitled to cast a majority of votes will be necessary to constitute a quorum for the transaction of business at the Annual Meeting. WITHHOLD votes with respect to Director nominees and ABSTAINabstain votes will be counted in determining the presence of a quorum as well as shares subject to broker non-votes if the broker votes the shares on a routine matter, such as the ratification of the appointment of the Company’s independent auditors (Proposal 2). Under Pennsylvania law and the Company’s By-Laws, ABSTAIN votes and broker non-votes are not considered to be “votes cast” and, therefore, although they will be counted for purposes of determining a quorum, they will not be given effect either as FOR or WITHHOLD / AGAINST votes.

What vote is needed for the election of Directors, and what is the policy with respect to the resignation of Directors who do not receive a majority of the votes?

With regard to Proposal 1, Shareholders may vote FOR or WITHHOLD with respect to the election of Directors. Directors are elected by a plurality of the votes cast, by those in personattendance at the virtual Annual Meeting or by Proxy, subject to the Company’s By-Law provision described below. The Company’s By-Laws set forth the procedures if a Director nominee does not receive at least a majority of votes cast in an uncontested election of Directors where a quorum is present. In an uncontested election, an incumbent Director nominee who receives the support of less than a majority of the votes cast at an Annual Meeting, although deemed to have been elected to the Board by plurality vote, must promptly tender his or her resignation to the Board. In an uncontested election, if a nominee who is not an incumbent does not receive the vote of at least a majority of the votes cast, the nominee will be deemed to have been elected to the Board by plurality vote and to have immediately resigned.

For this purpose, “majority of votes cast” means the number of shares voted FOR a Director’s election exceeds 50% of the total number of votes cast with respect to the Director’s election. “Votes cast” includes only FOR and WITHHOLD votes. Under Pennsylvania law and the Company’s By-Laws, broker non-votes are not considered to be “votes” and, therefore, will not be given effect either as FOR or WITHHOLD votes in the context of Proposal 1.

| 13 |

The Nominating and Corporate Governance Committee will evaluate the tendered resignation of an incumbent Director who does not receive a majority vote in an uncontested election and make a recommendation to the Board as to whether the

What vote is needed to approve all other proposals?

Proposals 2 3 and 43 require a FOR vote of a majority of the votes cast, by those in personattendance at the virtual Annual Meeting or by Proxy, in order to be approved.

ABSTAIN votes and broker non-votes will not be considered as votes cast and will have no effect on the outcome of the votes on these proposals.

Can I change or revoke my vote after I have delivered my Proxy?

Yes. If you are a record owner, prior to the Annual Meeting you may change your vote by submitting a later-dated Proxy in one of the manners authorized and described in this Proxy Statement (by Proxy Card, via the Internet or by telephone). You also may give a written notice of revocation to the Company’s Corporate Secretary, so long as it is delivered to the Corporate Secretary at the Company’s principal executive offices prior to the beginning of the Annual Meeting, or given to the Corporate Secretary at the Annual Meeting prior to the time your Proxy is voted at the Annual Meeting. You also may revoke any Proxy given pursuant to this solicitation by attendingvoting your shares electronically during the Annual Meeting and voting in person by ballot.Meeting. If you are a beneficial owner, please follow the instructions provided by your broker, bank or trust as to how you may changewith your vote or obtain a legal proxy to vote your sharesvoting instruction form if you wish to cast your vote in personelectronically at the Annual Meeting.

Who can attend the Annual Meeting?

Our virtual Annual Meeting will be conducted on the Internet via webcast. Shareholders of record on March 2, 2021 will be able to participate online, vote their shares electronically and Shareholders as of the March 5, 2019 Record Date may attendsubmit questions during the Annual Meeting. Record owners may attend without any prior authorization. If you are a beneficial owner, to be admitted toMeeting by visiting:

www.virtualshareholdingmeeting.com/CCK2021

To participate in the Annual Meeting, you will need proof of beneficial ownership satisfactorythe 16-digit control number included on your proxy card or your voting instruction form. The Annual Meeting will begin promptly at 9:30 a.m. Eastern Time. We encourage you to access the Annual Meeting prior to the Company in the form of a statement from the brokerage firm, bank or trust or a legal proxy from that institution showing you as a beneficial owner of Company shares or as the sole legal proxy of a beneficial owner. Allstart time. Online access will begin at 9:15 a.m. Eastern Time.

The virtual Annual Meeting attendees may be askedplatform is fully supported across browsers (Internet Explorer, Microsoft Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection wherever they intend to present valid, government-issued photo identification, such as a driver’s license or passport, before enteringparticipate in the Annual Meeting. Attendees will be subjectParticipants also should allow plenty of time to security inspectionslog in and will be requiredensure that they can hear streaming audio prior to comply with other security and procedural measures in place atthe start of the Annual Meeting. Representatives of

Shareholders may submit questions during the Company will beAnnual Meeting. If you wish to submit a question, you may do so by logging into the virtual meeting platform at

www.virtualshareholdingmeeting.com/CCK2021

and typing your question into the entrance“Ask a Question” field, and clicking “Submit.” Questions pertinent to the Annual Meeting and these representatives will be authorized onanswered during the Company’s behalfAnnual Meeting, subject to determine whethertime constraints.

| 14 |

If you encounter any difficulties accessing the admission policies and procedures are being followed and whether youvirtual Annual Meeting during the check-in or meeting time, please call 844-986-0822 (Toll Free) or 303-562-9302 for assistance. Technical support will be granted admission toavailable beginning at 9:15 a.m. Eastern Time on April 22, 2021 through the conclusion of the Annual Meeting.

Additional information regarding matters addressing technical and logistical issues, including technical support during the Annual Meeting, will be available at

www.virtualshareholdingmeeting.com/CCK2021

Where can I find voting results of the Annual Meeting?

The Company will announce the preliminary voting results at the Annual Meeting and publish the final results in a Form 8-K or Form 10-Q filed with the Securities and Exchange Commission (“SEC”) within four business days after the date of the Annual Meeting.

15

The Company has engaged D.F. King to assist in the solicitation of Proxies for a fee of $10,000 plus reimbursement for out-of-pocket expenses and certain additional fees for services rendered in connection with such solicitation. Certain Officers and employees of the Company may also solicit Proxies by mail, telephone, internetInternet or facsimile or in person without any extra compensation. The Company bears the cost of soliciting Proxies.

What is the deadline for proposals for consideration or for nominations of individuals to serve as Directors at the 20202022 Annual Meeting of Shareholders?

Proposals to be Considered for Inclusion in the Company’s Proxy Materials:

In order to be considered for inclusion in the Proxy Statement for the Company’s 20202022 Annual Meeting

of Shareholders, any Shareholder proposal intended to be presented at that meeting, in addition to meeting the shareholder eligibility and other requirements of the SEC rules governing such proposals, must be received in writing, via Certified Mail – Return Receipt Requested, by the Office of the Corporate Secretary, Crown Holdings, Inc., 770 Township Line Road, Yardley, PA 19067 not later than November 18, 2019.

Director Nominations for Inclusion in the Company’s Proxy Materials (Proxy Access):

Under certain circumstances, Shareholders may submit nominations for Directors for inclusion in the Company’s proxy materials by complying with the proxy access requirements in the Company’s By-Laws, which require nominations to be submitted in writing, via Certified Mail – Return Receipt Requested, and received at the above address not before October 17, 201916, 2021 nor after November 18, 2019.

Other Business and Director Nominations to Be Brought Before the 20202022 Annual Meeting of Shareholders:

The Company’s By-Laws currently provide that a Shareholder of record at the time that notice is given to the Company and who is entitled to vote at an annual meeting may bring business before the meeting or nominate a person for election to the Board of Directors if the Shareholder gives timely notice of such business or nomination. To be timely, and subject to certain exceptions, notice in writing to the Corporate Secretary must be delivered or mailed, via Certified Mail – Return Receipt Requested, and received at the above address not before October 17, 201916, 2021 nor after November 18, 2019.15, 2021. The notice must describe various matters regarding the nominee or proposed business. Any Shareholder desiring a copy of the Company’s By-Laws will be furnished one copy without charge upon written request to the Corporate Secretary.

| 15 |

How can I access the Proxy materials overon the Internet?

The Company has made available copies of the following materials at the Company’s website at:

https://www.crowncork.com/investors/proxy-online

| this Proxy Statement |

| the Proxy Card relating to the Annual Meeting of Shareholders |

| the Annual Report to Shareholders |

Information included on the Company’s website, other than this Proxy Statement, the Proxy Card and the Annual Report to Shareholders, is not part of the Proxy soliciting materials.

16

The Company filed its Annual Report on Form 10-K for the fiscal year ended December 31, 20182020 with the SEC on February 28, 2019.26, 2021. A copy of the Company’s Annual Report on Form 10-K was included as part of the Annual Report to Shareholders that you received along with the proxy materials. Any Shareholder can obtain a copy of the Annual Report, including the financial statements and schedules thereto and a list describing all the exhibits not contained therein, without charge. Requests for copies of the Annual Report should be sent to: Investor Relations Department, Crown Holdings, Inc., 770 Township Line Road, Yardley, PA 19067 or you may call toll free 888-400-7789. Copies in electronic format of the Company’s Annual Report and filings with the SEC are available at the Company’s website at www.crowncork.com in the “For Investors” section.

| 16 |

PROPOSAL 1: ELECTION OF DIRECTORS

The persons named in the Proxy Holders shall vote the shares with respect to the nominees listed below, all of whom are now Directors of the Company, to serve as Directors for the ensuing year or until their successors shall be elected. None of the persons named as a nominee for Director has indicated that he or she will be unable or will decline to serve. In the event that any of the nominees are unable or decline to serve, which the Nominating and Corporate Governance Committee of the Board of Directors does not believe will happen, the persons named in the Proxy Holders will vote with respect to the remaining nominees and others who may be nominated by the Board of Directors.

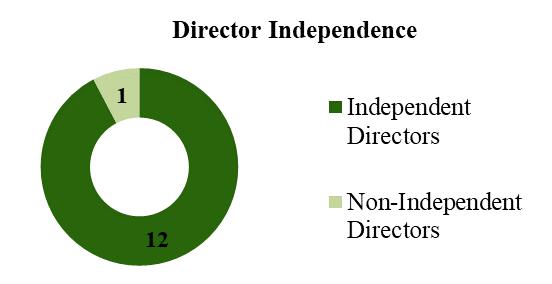

The By-Laws of the Company provide for a Board of Directors consisting of between 10 and 18 Directors, as determined by the Board of Directors. The Board of Directors has fixed the number of Directors at 11.13. It is intended that the Proxies will be voted for the election of the 1113 nominees named below as Directors, and no more than 1113 will be nominated by the Board.

The Board is committed to regular review of the Board’sits composition to ensure that the Board continues to have the right mix of skills, background and tenure. This year’s Board nominees include one new Director – Dwayne Wilson. Six of the Company’s independent Directors have joined the Board in the last five years as a result of a Board refreshment process where Director candidates were identified through Board, Shareholder and third-party search firm input. Our ongoing Board refreshment strategy has further strengthened and diversified the skills and experiences of the Board. The Board believes that the collective combination of backgrounds, skills and experiences of its members has produced a Board that is well-equipped to exercise oversight responsibilities for the Company’s Shareholders and to help guide the Company to achieve its long-term strategic objectives.

Under the Company’s Corporate Governance Guidelines, no Director will commence a term of Board service if the Director is over 75 years old unless the Board determines that an additional term of Board service would be in the best interests of the Company. Mr. Little, the Board’s Independent Presiding Director, and Mr. Löliger will both be 76 as of the date of the 2019 Annual Meeting. The Board has requested both of these Directors to serve one additional year prior to their expected retirement, subject to Shareholder approval of election of Directors at the 2019 Annual Meeting. The Board made this request in order to retain the executive experience of these two Directors in running international packaging companies outside of the metal container sector as the Company continues to integrate last year’s acquisition of global transit-packaging company Signode. Each has stepped down from one of the two Board Committees on which he previously served so that other Board members can join.

The names of the nominees and information concerning them and their associations as of March 5, 2019,2, 2021, as furnished by the nominees, follow. The principal occupations and the directorships stated include the nominees’ occupations and directorships with any U.S. publicly traded companies or registered investment companies during the last five years.

The Board of Directors Recommends that Shareholders Vote FOR Election

of Each of the Nominees Named Below.

| 17 |

| Name | Age | Principal Occupation | Year Became Director | |

John W. Conway (a) | 75

| Chairman of the Board and former Chief Executive Officer of the Company; also a Director of PPL Corporation | 1997 | |

Timothy J. Donahue (a) | 58 | President and Chief Executive Officer of the Company | 2015 | |

Richard H. Fearon

| 64 | Vice Chairman and Chief Financial and Planning Officer and Director of Eaton Corporation[1]; also a Director of Avient Corporation and CRH plc | 2019 | |

Andrea J. Funk (b) (c) | 51 | VP Finance, Americas of EnerSys; former Chief Executive Officer of Cambridge-Lee Industries; former Director of Destination Maternity Corporation | 2017 | |

Stephen J. Hagge (c) | 69 | Former President, Chief Executive Officer and Director of AptarGroup; also a Director of CF Industries Holdings | 2019 | |

Rose Lee (d) | 55 | President of DuPont Water & Protection | 2016 | |

James H. Miller (a) (c) (d) | 72 | Former Chairman and Chief Executive Officer of PPL Corporation; also a Director of AES Corporation | 2010 | |

Josef M. Müller (b) (c) | 73 | Former Chairman and Chief Executive Officer of Nestlé in the Greater China Region | 2011 | |

B. Craig Owens (b) | 66 | Former Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company; also a Director of AptarGroup; former Director of J.C. Penney Company | 2019 | |

Caesar F. Sweitzer (a) (b) (d) | 70 | Former Senior Advisor and Managing Director of Citigroup Global Markets | 2014 | |

Jim L. Turner (a) (c) (d) | 75 | Chief Executive Officer of JLT Beverages; former Chairman, President and Chief Executive Officer of Dr Pepper/Seven Up Bottling Group; also a Director of Comstock Resources | 2005 | |

William S. Urkiel (b) (d) | 75 | Former Senior Vice President and Chief Financial Officer of IKON Office Solutions; former Director of Roadrunner Transportation Systems | 2004 | |

Dwayne A. Wilson (b) | 62 | Former Senior Vice President of Fluor Corporation; Director of Sterling Construction Company and Ingredion Incorporated; former Director of AK Steel Holding Corporation | 2020 | |

| (a) Member of the Executive Committee | (c) Member of the Compensation Committee | |||

| (b) Member of the Audit Committee | (d) Member of the Nominating and Corporate Governance Committee | |||

[1] Mr. Fearon will retire as a director and officer of Eaton Corporation on March 31, 2021.

| 18 |

| Name | Age | Principal Occupation | Year Became Director | |

John W. Conway (a) | 73 | Chairman of the Board and former Chief Executive Officer of the Company; also a Director of PPL Corporation | 1997 | |

Timothy J. Donahue (a) | 56 | President and Chief Executive Officer of the Company | 2015 | |

Andrea J. Funk (b) (c) | 49 | VP Finance, Americas of EnerSys; former Chief Executive Officer of Cambridge-Lee Industries; also a Director of Destination Maternity Corporation | 2017 | |

Rose Lee (b) (d) | 53 | President of DuPont Safety & Construction; former officer of several Saint-Gobain companies | 2016 | |

William G. Little (a) (d) | 76 | Former Chairman and Chief Executive Officer of West Pharmaceutical Services | 2003 | |

Hans J. Löliger (a) (c) | 76 | Vice Chairman of GTF Holding; former Chief Executive Officer of SICPA Group | 2001 | |

James H. Miller (c) (d) | 70 | Former Chairman and Chief Executive Officer of PPL Corporation; also a Director of AES Corporation and McDermott International; former Director of Rayonier Advanced Materials | 2010 | |

Josef M. Müller (b) (c) | 71 | Former President of Swiss Association of Branded Consumer Goods “PROMARCA”; former Chairman and Chief Executive Officer of Nestlé in the Greater China Region | 2011 | |

Caesar F. Sweitzer (b) (d) | 68 | Former Senior Advisor and Managing Director of Citigroup Global Markets | 2014 | |

Jim L. Turner (c) (d) | 73 | Principal of JLT Beverages; former Chairman, President and Chief Executive Officer of Dr Pepper/Seven Up Bottling Group; also Chairman of Dean Foods and a Director of Comstock Resources | 2005 | |

William S. Urkiel (b) (d) | 73 | Former Senior Vice President and Chief Financial Officer of IKON Office Solutions; also a Director of Roadrunner Transportation Systems | 2004 | |

| (a) Member of the Executive Committee | (c) Member of the Compensation Committee | |||

| (b) Member of the Audit Committee | (d) Member of the Nominating and Corporate Governance Committee | |||

The Nominating and Corporate Governance Committee is responsible for leading the search for individuals qualified to become members of the Board of Directors and recommending candidates to the Board as Director nominees. The Board desires a diverse membership, including with respect to race, gender, nationality and ethnicity as well as professional background and geographic and industry experience. The Nominating and Corporate Governance Committee assesses each potential nominee’s overall mix of experiences, qualifications, perspectives, talents, education and skills as well as each potential nominee’s ability to contribute to the Board and to enhance the Board’s decision-making process. Independence is a key factor when considering the Director nominees, as are critical thinking skills, practical wisdom and mature judgment in the decision-making process. For a description of the identifying and evaluating procedures of the Nominating and Corporate Governance Committee, see “Corporate Governance – Nominating and Corporate Governance Committee.” The Board believes that each of the nominees listed above has the sound character, integrity, judgment and record of achievement necessary to be a member of the Board and is independent of the influence of any particular Shareholder or group of Shareholders whose interests may diverge from the interests of the Company’s Shareholders as a whole. In addition, each of the nominees has exhibited during his or her prior service as a Director, the ability to operate cohesivelyconstructively with the other members of the Board and to challenge and question management in a constructiveproductive way.

The Board believes, moreover, that each nominee brings a strong and unique background and skill set to the Board, giving the Board as a whole competence and experience in diverse areas. These areas include organizational leadership; public company board service; manufacturing; finance; management in the packaging, food and beverage sectors and other relevant industries; and international business and markets. The Board believes that the following specific experiences, qualifications and skills, together with the aforementioned attributes, qualify each of the nominees listed above to serve as a Director.

John Conway. Mr. Conway, the Company’s independent non-executive Chairman of the Board, served as the CEO of the Company for over 15 years until his retirement at year-end 2015, as a member of the Board since 1997 and in other positions, both domestic and international, with the Company and its predecessors for over 40 years. He gives the Board seasoned leadership and an in-depth knowledge of the Company, especially its international business. Mr. Conway also serves as lead directorLead Director of another NYSE-listed company.

Timothy Donahue. Mr. Donahue assumed the position of CEO of the Company in 2016. He has served as a member of the Board since 2015 and in other executive positions with the Company for over 2830 years. He brings to the Board an intimate understanding of the operations and finances of the Company from his prior experience as the Company’s Chief Operating Officer and Chief Financial Officer.

Richard Fearon. Mr. Fearon’s experience as a CFO of an NYSE-listed global, diversified manufacturing company brings to the Board comprehensive knowledge of financial accounting and extensive experience in financial reporting, corporate finance and capital markets, corporate development, strategic planning, mergers and acquisitions, risk management and investor relations. In addition, his service as a Lead Director of an NYSE-listed global provider of specialized polymers also provides significant governance experience. Mr. Fearon also serves as a director of another publicly-listed company. Mr. Fearon will retire as a director and officer of Eaton Corporation on March 31, 2021.

Andrea Funk. Ms. Funk’s experience as VP Finance of the AmericanAmericas division of an NYSE-listed international manufacturing company and as former CEO and CFO of an international manufacturing and distribution business brings to the Board significant experienceexpertise in the areas of finance, operations and strategy. This, along with Ms. Funk’s prior experience in public accounting, enhanceenhances her contributions to the Audit Committee and qualifies her as an “audit committee financial expert” within the meaning of SEC regulations. Ms. Funk

| 19 |

Stephen Hagge. Mr. Hagge brings to the Board substantial leadership and management experience in public company governance, operations, international business, strategic initiatives and risk management from his role as former CEO, CFO and COO of an NYSE-listed global packaging manufacturer. Mr. Hagge also serves as a director of a Nasdaq-listedanother NYSE-listed company.

Rose Lee. Ms. Lee brings to the Board a deep knowledge of operations, engineering and technology from her experience in engineering and information technology. She also brings senior management experience and a broad global perspectiveto the Board from her role as president of a global business segment of an NYSE-listed international manufacturing company. She also brings a deep knowledge of operations, engineering and technology matters that enhances her contribution to the Nominating and Corporate Governance Committee’s oversight of the Company’s sustainability efforts.

20

Josef Müller. Mr. Müller, a European national, has over 35 years of senior management experience at a global food and beverage company, including as the CEO of that company’s greater China region. Mr. Müller brings to the Board significant emerging market business development and management experience.

B. Craig Owens. Mr. Owens’ extensive experience in the consumer food and beverage industries, including his former service as the CFO of a leading NYSE-listed international consumer food company, brings to the Board significant financial expertise, including all aspects of financial reporting, accounting, corporate finance and capital markets, as well as significant experience in strategic planning, business integration and operations, and in managing supply chain organizations. He also has considerable knowledge of the retail industry having served as CFO of a leading international grocery retailer. Mr. Owens also serves as a director of another NYSE-listed company.

Caesar Sweitzer. Mr. Sweitzer spent over 35 years in finance, primarily as an investment banker focusing on industrial companies. Mr. Sweitzer brings to the Board significant knowledge of the global packaging industry as well as finance and investment matters, such as acquisitions, dispositions and corporate finance. Mr. Sweitzer’s experience qualifies him as an “audit committee financial expert” within the meaning of SEC regulations, and he chairs the Audit Committee.

Jim Turner. Mr. Turner’s extensive experience in the soft drink industry, and in particular his experience as owner and CEO of the largest independent soft drink bottler in the U.S., gives the Board deep insight into the industry of many of the Company’s significant customers. Mr. Turner has valuable experience in business development, finance and mergers and acquisitions. Mr. Turner also chairs the boardCompensation Committee and also serves as a director of aanother NYSE-listed food and beverage company.

William Urkiel. Mr. Urkiel’s experience as CFO of a NYSE-listed provider of innovative document management systems and services brings to the Board both leadership skills and comprehensive knowledge of accounting, finance and capital markets and corporate governance matters. Mr. Urkiel’s accounting and finance experience qualify him as an “audit committee financial expert” within the meaning of SEC regulations, and he serves on the Audit Committee.

Dwayne Wilson. Mr. UrkielWilson brings to the Board over 36 years of senior management experience at a leading NYSE-listed construction and engineering company. Mr. Wilson has gained a broad range of experience and exposure to a number of diverse end markets, and the Company will benefit from his knowledge and perspective, particularly in the areas of manufacturing, technology, operational excellence and engineering. Mr. Wilson also serves as a director of another NYSE-listed company.two other publicly-listed companies.

| 20 |

DIRECTOR COMPENSATION

The following table lists 20182020 Director compensation for all Non-Employeeindependent Directors who servedreceived compensation as Directors in 2018.2020. Compensation for Mr. Donahue, the Company’s Chief Executive Officer, is reported in the Summary Compensation Table included in the Executive Compensation section below. Mr. Donahue does not earn additional compensation for his service as Director.

Name | Fees Earned or Paid in Cash (1) |

Stock Awards (2) |

Total |

| John Conway | $180,000 | $145,000 | $325,000 |

| Richard Fearon | 100,000 | 145,000 | 245,000 |

| Andrea Funk | 125,000 | 145,000 | 270,000 |

| Stephen Hagge | 110,000 | 145,000 | 255,000 |

| Rose Lee | 117,500 | 145,000 | 262,500 |

| William Little (3) | 52,500 | 72,500 | 125,000 |

| Hans Löliger (3) | 52,500 | 72,500 | 125,000 |

| James Miller | 155,000 | 145,000 | 300,000 |

| Josef Müller | 125,000 | 145,000 | 270,000 |

| B. Craig Owens | 111,250 | 145,000 | 256,250 |

| Caesar Sweitzer | 135,000 | 145,000 | 280,000 |

| Jim Turner | 130,000 | 145,000 | 275,000 |

| William Urkiel | 125,000 | 145,000 | 270,000 |

| (1) | Each Director may defer receipt of all, or any part, of his or her cash compensation until termination of service as a Director. At the election of the Director, deferred cash compensation amounts are paid in either a lump sum or installments over a period not to exceed 10 years after departure from the Board and are credited with interest at the prime rate until distributed. |

| (2) | The annual grant of Company Common Stock for 2020 consisted of $145,000 of Company Common Stock under the Stock Compensation Plan for Non-Employee Directors and was paid on a quarterly basis. The number of shares paid each quarter is determined based on the average of the closing market price of the Company’s Common Stock on each of the second through sixth business days following the date on which the Company publicly released its quarterly results. |

| (3) | Messrs. Little and Löliger retired as Directors of the Company pursuant to the Company’s mandatory retirement rules and did not stand for re-election in April 2020. |

| 21 |

Name | Fees Earned or Paid in Cash (1) | Stock Awards (2) | Total |

| John Conway | $180,000 | $135,000 | $315,000 |

Arnold Donald (3) | 107,000 | 135,000 | 242,000 |

| Andrea Funk | 110,000 | 135,000 | 245,000 |

| Rose Lee | 110,000 | 135,000 | 245,000 |

| William Little | 152,000 | 135,000 | 287,000 |

| Hans Löliger | 127,000 | 135,000 | 262,000 |

| James Miller | 107,000 | 135,000 | 242,000 |

| Josef Müller | 117,000 | 135,000 | 252,000 |

| Caesar Sweitzer | 125,000 | 135,000 | 260,000 |

| Jim Turner | 114,000 | 135,000 | 249,000 |

| William Urkiel | 117,000 | 135,000 | 252,000 |

(1) Each Director may defer receipt of all, or any part, of his or her cash compensation until termination of service as a Director. At the election of the Director, deferred cash compensation amounts are paid in either a lump sum or installments over a period not to exceed 10 years after departure from the Board and are credited with interest at the prime rate until distributed. (2) The annual grant of Company Common Stock for 2018 consisted of $135,000 of Company Common Stock under the Stock Compensation Plan for Non-Employee Directors and was paid on a quarterly basis. The number of shares paid each quarter is determined based on the average of the closing market price of the Company’s Common Stock on each of the second through sixth business days following the date on which the Company publicly released its quarterly results. (3) Mr. Donald is not standing for re-election to the Board at the Company’s 2019 Annual Meeting of Shareholders due to competing commitments. | |||

The Board periodically receives benchmarking data regarding director compensation from Pay Governance the Board’sLLC, an executive compensation consulting firm, and uses the 50thpercentile of its peer group’s target total cash compensation and target total direct compensation as a market check in determining director compensation. In 2019,For 2021, Directors who are not employees of the Company will receive annual cash base fees, grants of Company Common Stock and cash committee fees in the amounts set forth as follows, which are unchanged from 2018.follows.

Cash Base Fee | $100,000 |

| Equity Grant | |

| Supplemental Cash Committee Fees: | |

· · · | 25,000 15,000 20,000 10,000 |

| Non-Executive Board Chairman Fee | 80,000 |

| Independent | 25,000 |

Directors do not receive any additional fees for their service on the Executive Committee. There are no Board or committee meeting attendance fees. Directors are reimbursed by the Company for travel and related expenses they incur in connection with their service on the Board and its committees.

| 22 |

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table shows, as of March 5, 2019,2, 2021, the number of shares of Company Common Stock beneficially owned by each person or group that is known to the Company to be the beneficial owner of more than 5% of the Company’s outstanding Common Stock.

Name and Address

| Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly | Percentage of Outstanding Shares (1)

|

The Vanguard Group (2) 100 Vanguard Blvd. Malvern, PA 19355 | 11,968,559 | 8.9% |

JP Morgan Chase & Co. (3) 383 Madison Avenue New York, NY 10179 | 8,518,556 | 6.3% |

Janus Henderson Group plc (4) 201 Bishopsgate EC2M 3AE United Kingdom | 7,323,332 | 5.4% |

BlackRock, Inc. (5) 55 East 52nd Street New York, NY 10055 | 6,812,394 | 5.0% |

(1) Percentages are derived based upon 134,912,097 shares of Common Stock outstanding as of March 2, 2021. (2) The Vanguard Group, an investment advisor, reported that it may be deemed to be the beneficial owner of 11,968,559 shares of the Company’s Common Stock. The Vanguard Group reported that it had sole dispositive power with respect to 11,745,103 shares, including 117,151 shares for which it had shared voting power, and shared dispositive power with respect to 223,456 shares. (3) JP Morgan Chase & Co., a parent holding company, reported that it may be deemed to be the beneficial owner of 8,518,556 shares of the Company’s Common Stock. JP Morgan Chase & Co. reported that it had sole dispositive power with respect to 8,487,669 shares, including 7,778,630 shares for which it had sole voting power and 28,950 shares for which it had shared voting power, and shared dispositive power with respect to 29 shares. (4) Janus Henderson Group plc, a parent holding company, reported that it may be deemed to be the beneficial owner of 7,323,332 shares of the Company’s Common Stock. Janus Henderson Group plc reported that it had shared voting power and shared dispositive power with respect to 7,323,332 shares. (5) BlackRock, Inc., a parent holding company, reported that it may be deemed to be the beneficial owner of 6,812,394 shares of the Company’s Common Stock. BlackRock, Inc. reported that it had sole dispositive power with respect to 6,812,394 shares, including 6,068,303 shares for which it had sole voting power. | ||

| 23 |

Name and Address | Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly | Percentage of Outstanding Shares (1) |

The Vanguard Group (2) 100 Vanguard Blvd. Malvern, PA 19355 | 12,421,565 | 9.2% |

FMR LLC (3) 245 Summer Street Boston, MA 02210 | 8,692,721 | 6.4% |

BlackRock, Inc. (4) 55 East 52nd Street New York, NY 10055 | 7,654,289 | 5.7% |

JPMorgan Chase & Co. (5) 270 Park Avenue New York, NY 10017 | 7,462,106 | 5.5% |

Janus Henderson Group plc (6) 201 Bishopsgate EC2M 3AE United Kingdom | 7,256,215 | 5.4% |

(1) Percentages are derived based upon 135,328,379 shares of Common Stock outstanding as of March 5, 2019. (2) The Vanguard Group, an investment advisor, reported that it may be deemed to be the beneficial owner of 12,421,565 shares of the Company’s Common Stock. The Vanguard Group reported that it had sole dispositive power with respect to 12,297,152 shares, including 99,877 shares for which it had sole voting power and 30,555 shares for which it had shared voting power, and shared dispositive power with respect to 124,413 shares. (3) FMR LLC, a parent holding company, reported that it may be deemed to be the beneficial owner of 8,692,721 shares of the Company’s Common Stock. FMR LLC reported that it had sole dispositive power with respect to 8,692,721 shares, including 1,761,164 shares for which it had sole voting power. (4) BlackRock, Inc., a parent holding company, reported that it may be deemed to be the beneficial owner of 7,654,289 shares of the Company’s Common Stock. BlackRock, Inc. reported that it had sole dispositive power with respect to 7,654,289 shares, including 6,869,389 shares for which it had sole voting power. (5) JPMorgan Chase & Co., a parent holding company, reported that it may be deemed to be the beneficial owner of 7,462,106 shares of the Company’s Common Stock. JPMorgan Chase & Co. reported that it had sole dispositive power with respect to 7,459,671 shares, including 6,285,309 shares for which it had sole voting power and 1,575 shares for which it had shared voting power, and shared dispositive power with respect to 2,435 shares. (6) Janus Henderson Group plc, a parent holding company, reported that it may be deemed to be the beneficial owner of 7,256,215 shares of the Company’s Common Stock. Janus Henderson Group plc reported that it had shared voting power and shared dispositive power with respect to 7,256,215 shares. | ||

The following table shows, as of March 5, 2019,2, 2021, the number of shares of Common Stock beneficially owned by each Director; the Company’s Chief Executive Officer, Chief Financial Officer and the three other Executive Officers who were the highest paid during 2018;2020; and all Directors and Executive Officers as a group. The Directors and Executive Officers of the Company have sole voting and dispositive power with respect to the securities of the Company listed in the table below.

Name | Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly | Percentage of Outstanding Shares (1) |

| John Conway | 1,031,933 | * |

| Timothy Donahue (2) | 637,682 | * |

| Richard Fearon (3) | 3,531 | * |

| Andrea Funk | 8,564 | * |

| Gerard Gifford | 161,896 | * |

| Stephen Hagge | 2,338 | * |

| Thomas Kelly (2) | 133,172 | * |

| Rose Lee | 10,134 | * |

| James Miller | 25,001 | * |

| Josef Müller | 24,314 | * |

| Djalma Novaes | 77,473 | * |

| B. Craig Owens | 2,338 | * |

| Didier Sourisseau | 91,760 | * |

| Caesar Sweitzer | 15,914 | * |

| Jim Turner | 92,725 | * |

| William Urkiel | 51,944 | * |

| Dwayne Wilson | 368 | * |

| Directors and Executive | ||

| Officers as a Group of 20 | 2,499,081 | 1.9% |

| * Less than 1% | ||

(1) Percentages are derived based upon 134,912,097 shares of Common Stock outstanding as of March 2, 2021. (2) Excludes 3,000,000 shares of Common Stock held in the Crown Cork & Seal Company, Inc. Master Retirement Trust on behalf of various Company pension plans (“Trust Shares”). Messrs. Donahue and Kelly are members of the Benefits Plan Investment Committee of the trust that has sole voting and dispositive power with respect to the Trust Shares, but they disclaim beneficial ownership of the Trust Shares. (3) Includes 16 shares of Common Stock held by the Fearon Family Trust, of which Mr. Fearon is a trustee and a beneficiary. | ||

| 24 |

Name | Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly | Percentage of Outstanding Shares (1) |

| Robert Bourque | 47,485 | * |

| John Conway | 1,157,064 | * |

| Timothy Donahue (2) | 548,867 | * |

Arnold Donald (3) | 23,268 | * |

| Andrea Funk | 4,618 | * |

| Gerard Gifford (4) | 178,140 | * |

| Thomas Kelly (2) | 115,417 | * |

| Rose Lee | 6,188 | * |

| William Little | 52,565 | * |

| Hans Löliger | 75,684 | * |

| James Miller | 21,055 | * |

| Josef Müller | 20,368 | * |

| Didier Sourisseau | 66,863 | * |

| Caesar Sweitzer | 11,968 | * |

| Jim Turner | 88,779 | * |

| William Urkiel | 47,998 | * |

| Directors and Executive | ||

| Officers as a Group of 19 | 2,589,467 | 1.9% |

| * Less than 1% | ||

(1) Percentages are derived based upon 135,328,379 shares of Common Stock outstanding as of March 5, 2019. (2) Excludes 3,000,000 shares of Common Stock held in the Crown Cork & Seal Company, Inc. Master Retirement Trust on behalf of various Company pension plans (“Trust Shares”). Messrs. Donahue and Kelly are members of the Benefits Plan Investment Committee of the trust that has sole voting and dispositive power with respect to the Trust Shares, but they disclaim beneficial ownership of the Trust Shares. (3) Includes 6,898 shares of Common Stock held in a revocable family trust, of which Mr. Donald is trustee. (4) Includes 30,000 shares of Common Stock subject to presently exercisable options held by Mr. Gifford. | ||

CORPORATE GOVERNANCE

Meetings of the Board of Directors. In 2018,2020, there were fiveseven meetings of the Board of Directors. Each Director during his or her term of service attended at least 75% of the aggregate meetings of the Board and of the committees on which he or she served.

Attendance at the Annual Meeting. Under the Company’s Corporate Governance Guidelines, Directors are expected to attend the Company’s Annual Meeting of Shareholders. In 2018,2020, each of the Directors serving on the Board at the time attended the Annual Meeting of Shareholders.

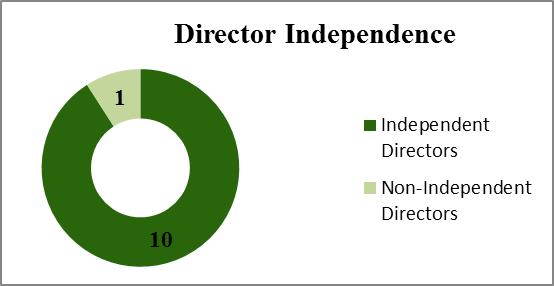

Director Independence. The Board has determined that all Directors standing for election, with the exception of Timothy Donahue, the Company’s Chief Executive Officer, are independent under the listing standards of the NYSE. The Board made this determination based on the absence of any of the express disqualifying criteria set forth in the listing standards that require a majority of the Board nominees to be independent Directors.